How IDP Transforms Insurance Claims Processing

Learn how Intelligent Document Processing (IDP) is revolutionizing insurance claims processing by automating document classification, data extraction, and validation.

Introduction

Insurance claims processing has traditionally been bogged down by manual steps—sorting paperwork, entering data by hand, and validating information against policy rules. For instance, auto repair claims still take an average of 23.1 days to settle due to manual inefficiencies, more than double pre-pandemic times (decerto.com). In the UK, bereavement claims can drag on for two to four months, causing financial hardship and emotional distress for policyholders (ft.com). Intelligent Document Processing (IDP) offers a way to slash turnaround times, cut errors, and elevate customer satisfaction by automating the classification, extraction, and validation of claim documents.

What Is Intelligent Document Processing?

Intelligent Document Processing (IDP) leverages optical character recognition (OCR), natural language processing (NLP), and machine learning (ML) to transform unstructured documents—PDFs, scanned forms, images—into structured data ready for downstream systems (indicodata.ai, indicodata.ai). Unlike legacy OCR solutions that simply convert images to text, modern IDP platforms classify documents by type, extract key fields like policy numbers and incident dates, and validate data against business rules and external sources—all with minimal human intervention (indicodata.ai).

Automating Claim-Form Classification

A critical first step is document classification—routing each incoming file (e.g., CMS-1500 medical forms, police reports, loss estimates) into the correct workflow. Today, roughly 80% of claims are auto-adjudicated with limited human review, but the remaining 20% undergo manual inspection, which can take days or weeks and cost up to $20 per claim for manual review alone (onepercentsteps.com). By training AI models on claim-type layouts and content, insurers like Trygg-Hansa have achieved 95% faster personal claims processing, vastly speeding up classification and routing (blueprism.com).

Automating Data Extraction

Once classified, IDP applies OCR and NLP to extract essential data fields. Case in point: Omega Healthcare Management Services automated its FNOL (First-Notice-of-Loss) report processing to achieve 99.5% extraction accuracy and cut turnaround times by 50%, saving over 15,000 employee hours per month (businessinsider.com). Similarly, leading insurers deploying IDP report 95%+ accuracy on structured forms, enabling straight-through processing of clean claims in hours instead of days (indicodata.ai).

Automating Data Validation

Accurate extraction must be paired with validation. IDP platforms automatically cross-reference extracted fields against policy databases, premium schedules, and historical claims to flag anomalies—such as expired coverage or suspiciously large payouts. Automation in fraud detection can identify potential fraud 50% faster and reduce fraudulent payouts by up to 40%, helping insurers prevent leakage and control loss adjustment expenses (LAE) (feathery.io).

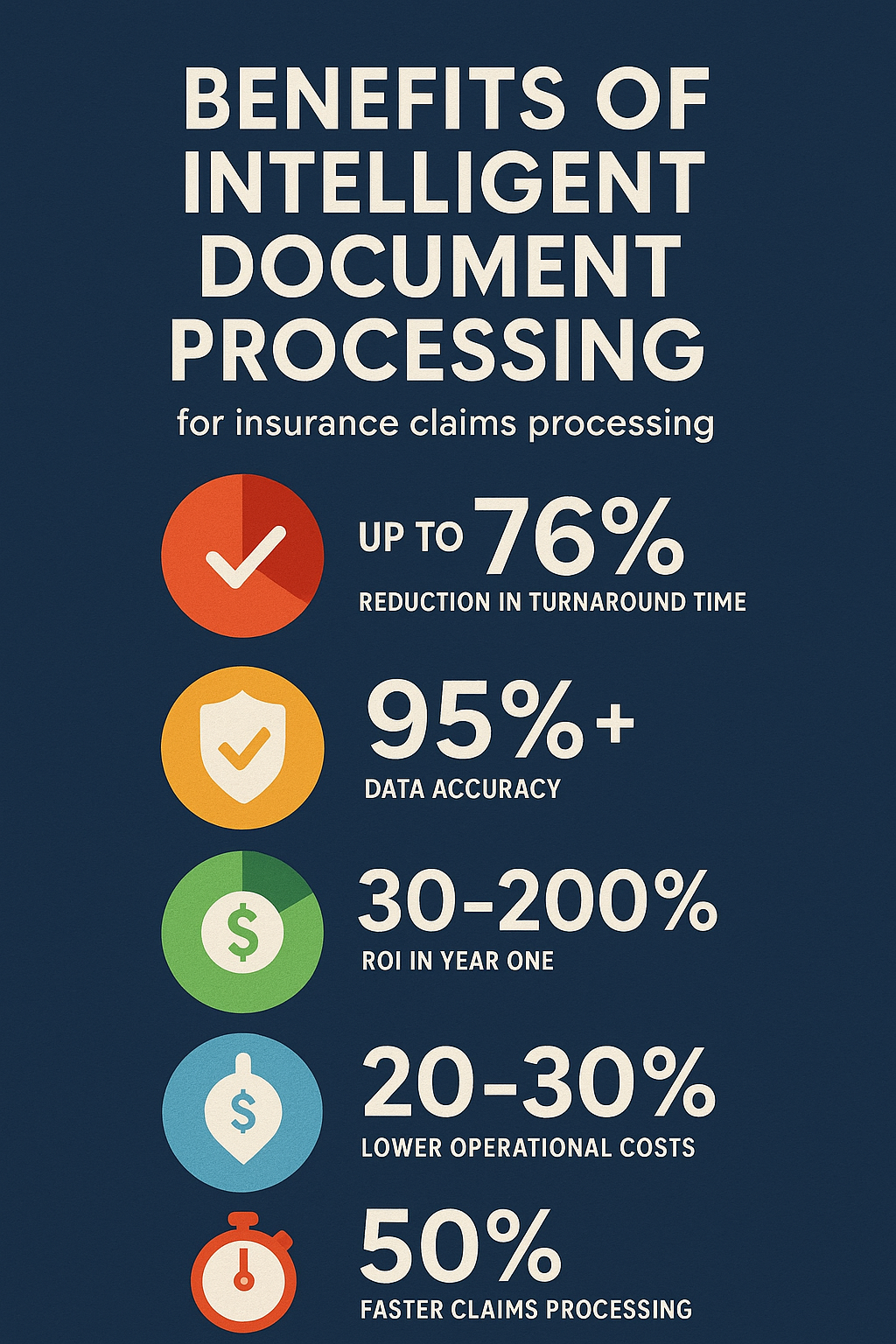

Key Benefits for Insurers

- Up to 76% reduction in turnaround time: A global risk manager cut its claim TAT by 76% using RPA + IDP (datamatics.com).

- 50% faster claims processing: Workflow automation can halve processing times, shifting settlements from weeks to days (feathery.io).

- 30–200% ROI in Year One: IDP investments often pay for themselves within months via labor and error-reduction savings (docsumo.com).

- 20–30% lower operational costs: Less manual entry and faster approvals drive significant overhead reductions (feathery.io).

- >99% data accuracy: Automation achieves near-perfect field extraction, reducing rework and compliance risks (businessinsider.com).

Implementation Considerations

- Document Assessment: Inventory your claim-type volumes and formats to prioritize high-impact use cases.

- Platform Selection: Opt for an API-first IDP solution that integrates seamlessly with your policy administration and claims management systems.

- Human-in-the-Loop: Build exception workflows where specialists review flagged items, enabling continuous model retraining and governance (abbyy.com).

- Compliance & Security: Ensure adherence to regulations like GDPR and maintain audit trails for every processing step.

Conclusion

By automating claim-form classification, data extraction, and validation, excelrate.ai empowers insurers to transform their claims workflows—slashing turnaround times, cutting errors, and boosting customer satisfaction. Ready to accelerate your claims processing? Request a demo at excelrate.ai.

Sources

- Decerto, “Streamlining Insurance Claims Processes with AI and Machine Learning,” Decerto.com. (decerto.com)

- Financial Times, “Insurers told to speed up bereavement claims,” FT.com. (ft.com)

- Indicodata.ai, “Improving accuracy in claims processing with Intelligent Document Processing.” (indicodata.ai)

- Indicodata.ai, “How Intelligent Document Processing (IDP) Transforms Claims Management.” (indicodata.ai)

- IndicoData.ai, “Intelligent Document Processing for Property and Casualty Insurance.” (indicodata.ai)

- OnePercentSteps, “Real-Time Adjudication for Health Insurance Claims.” (onepercentsteps.com)

- BluePrism.com, “Trygg-Hansa Process Claims 95% Faster | Automation Case Study.” (blueprism.com)

- Business Insider, “A healthcare giant is using AI to sift through millions of transactions,” BusinessInsider.com. (businessinsider.com)

- Datamatics.com, “A global provider of risk management reduces TAT by 76% with Automation.” (datamatics.com)

- Docsumo.com, “50 Key Statistics and Trends in Intelligent Document Processing.” (docsumo.com)

- Feathery.io, “Workflow Automation Statistics in Insurance.” (feathery.io)

- ABBYY, “Intelligent Document Processing Use Cases in Insurance,” ABBYY.com. (abbyy.com)

Tags

Jenny Lee

Head of Business Development

Jenny leads business development at excelrate.ai, helping insurers transform their document processing workflows.

Louis Mahl

Co-CEO and Cofounder

Louis is the co-CEO and cofounder of excelrate.ai, focusing on bringing innovative document processing solutions to enterprises.